Friday, April 17, 2009

Schrenker says he's writing a book

April 17, 2009 10:15 AM EST

Pensacola, FLA - An Indiana money manager accused of trying to fake his death in a plane crash tells a Florida newspaper that he hopes to write a book about his experiences.In a letter to the Pensacola News Journal, Marcus Schrenker wrote that he's tentatively titled his book "15 Years Up, 1 Night Down."Schrenker was arrested in a Florida campground in January, two days after officials say he put his plane on autopilot and bailed out over Alabama to flee personal and financial problems. The plane hit the ground about 200 miles away in Florida, where he faces federal charges in the crash near a residential area.In his letter to the newspaper, Schrenker wrote that "not a day goes by that I didn't wish I'd have gone down in that airplane with honor."Information from: Pensacola News Journal

Pilot mystery - See stories and documents on the Schrenker case

(Copyright 2009 Associated Press. All rights reserved. )

Sunday, April 12, 2009

When people trust wealth

© 2009 Indystar.com website.

April 12, 2009

As Marcus Schrenker's plane crashed, so did his high-rolling imageExperts say those who project wealth, success are too easily trusted.

By Francesca Jarosz

Dave Smith first met Fishers financial adviser Marcus Schrenker in June 2004, when Schrenker flew his plane to Atlanta to discuss Smith's finances.

Smith, a retired Delta Air Lines pilot who lives in Roswell, Ga., was blown away by Schrenker's immaculate appearance, expensive turboprop plane and apparent knowledge of Delta's financial problems.

He decided on the spot to invest with Schrenker, entrusting him to handle about $1.3 million in retirement savings.

"It was like so many times in your life when you think, 'God brought him to help,' " Smith said.

Five years later, Schrenker, 38, is being held at the Escambia County Jail in Pensacola, Fla., faced with federal charges that he tried to fake his own death in a plane crash after being accused of bilking hundreds of thousands of dollars from investors, including Smith.

He is scheduled to appear in federal court April 24 for a hearing to determine his competency to stand trial.

Schrenker's life and the events that led to his arrest are filled with made-for-TV movie details. But experts say how he, and those he allegedly duped, got to this point illustrates a broader cautionary tale about trust and about how so many people are drawn to those in society who project wealth, knowledge and success.

The downfall of Schrenker and others, such as Ponzi scheme artist Bernard Madoff, has provided a fresh look at the corruption that sometimes underlies financial achievement. That awareness, experts say, could create a greater skepticism of wealth and provide a wake-up call about using it as a basis of trust.

"There's a general suspicion of American business at this point -- you'd see the same thing in the 1930s," said Jerald Podair, a professor at Lawrence University in Appleton, Wis., who teaches a course on the Great Depression and the New Deal. "It's the Schrenkers of the world that give people that suspicion. He built this lifestyle that was supposed to project the American Dream, but it was a warped version of it that was built on deceiving people."

On Jan. 11, Schrenker flew his plane from Anderson, bound toward Florida. Hours later, authorities say, he placed a distress call and put his aircraft on autopilot before parachuting into central Alabama. The plane crashed in the Florida Panhandle, and authorities found Schrenker Jan. 13 at a Florida campground, bleeding from a slit wrist.

He is accused of intentionally crashing his plane and putting out a false distress call. His trial is set for June 8 in U.S. District Court in Pensacola.

After that, Schrenker will return to Indiana to face charges that he worked as an investment adviser without being registered. If convicted in both criminal cases, he could face a maximum of 42 years in prison and up to $520,000 in fines, plus restitution.

In a letter sent in March to Indiana officials, his family and media outlets, Schrenker said he'd been mentally unstable and abusing prescription drugs at the time investigators allege he bilked clients out of hundreds of thousands of dollars.

Schrenker said the plane episode was an accident and denied trying to evade authorities or leave the country.

"There is a lot the public doesn't know and soon the truth of what really happened on 1-11-2009 will be told," Schrenker wrote.

He left behind his wife, Michelle, who had recently filed for divorce; Kelly Baker, with whom he'd been having an affair for about a year; myriad lawsuits and civil cases against him and his companies, Icon Wealth Management, Heritage Wealth Management and Heritage Insurance Services.

The plane crash appeared to many as an attempt to flee a life that Schrenker once worked meticulously to create.

Gaining trust

Those who know Schrenker say he worked tirelessly to project an image of success.

He sported suspenders and ties almost every business day and kept his hair cut military-style, said Erick Krauter, a former landlord. He was known for sporting Armani suits, cuff links and monogrammed shirts.

The same care went into the upkeep of his three-story Geist home, where he washed the garage floor every night with steaming hot water, said Tamra Boles, who was friends with Marcus and Michelle in 2005. His office, too, was decked out with security cameras, state-of-the-art electronics, expensive light fixtures and granite tiling in the bathrooms.

"Everything about this man had to be perfect -- his office, his house," Krauter said. "He was absolutely over the top in everything he did."

Schrenker flaunted his wealth to friends, business partners and neighbors -- often talking about his companies' success or how much his cars cost. At his 10-year high school reunion, he handed out business cards with a picture of him and Michelle standing in front of their Lexus and plane.

For Michelle's 32nd birthday party, he hired a local band, flashed names of guests from a projector and ended the night with a fireworks show.

"A lot of people wanted to be him," said Dane Lantz, who took care of Schrenker's plane at Mount Comfort Airport, where many employees frequented the financial adviser's social events. "He had the planes and the cars and the (expensive) house."

Michael Edesess is chief investment officer for Fair Advisors, a Denver-based firm that attempts to ensure advisory work is done ethically. He said potential investors are easily misled by the appearance of wealth.

\

"They think, 'That person looks like they know how to make money, therefore they'll know how to make money for me,' " Edesess said. "The logical progression that they don't seem to make is, that person is wealthy, so he knows how to make money from me."

Former clients said Schrenker used his wealth to win them over, buying them artwork and GPS units and taking them out to expensive restaurants. He'd also become close to their families, calling to inquire about their children and to wish them a happy birthday.

Smith said that during his initial meeting with Schrenker, he was impressed by his businesslike talk, laced with statements such as, "We have people inside of Delta, and we know what's going on and it's bad."

But it was Schrenker's cordial, professional demeanor and his well-groomed, athletic appearance that sold him.

"I remember thinking, 'If he takes care of himself that well, he probably takes care of everything that well.' "

Coming out fighting

Schrenker's charm quickly won over clients and friends, but beneath the surface, many said he was a manipulative bully waiting to be unleashed.

Steve Shea, a retail developer who lives in Schrenker's neighborhood, became friends with him in 2002 through mutual acquaintances. They began a business relationship in 2004, when Schrenker became a tenant in one of Shea's retail developments.

Problems soon followed.

Schrenker refused to execute his six-month lease on the property and began finding flaws in the building -- excuses, Shea said, to avoid paying his rent. He sent Shea pages of e-mails with pictures of light switch plates that had screws missing, areas of the carpet where threads were loose and toilet paper rolls, which he said were not replaced each night.

In the e-mails, he warned about the dangers of electrical shorts, falls on the carpet and unsanitary conditions. On one occasion, he brought in Occupational Safety and Health Administration officials to test the building's air quality because someone was smoking in the building.

"It was always positioning to avoid paying the rent," said Shea, who kicked Schrenker out of the building about four months after he moved in. "The way to defend his position was to try to intimidate the other person."

The Kinney family said Schrenker used intimidation tactics on them, too.

Schrenker became close to members of the family, calling them in the middle of the week to check in, and on occasion spending weekends at their lake house.

But when Mike Kinney, a dentist from Roswell, Ga., began questioning Schrenker's handling of his funds after he noticed some money missing, he said Schrenker berated him for bothering him with calls.

Schrenker eventually resigned as Kinney's adviser, saying that he was potentially litigious as a client and that he harassed his staff.

After Kinney's parents, Harold and Margie, locked Schrenker out of their accounts because they also noticed money was missing, Kinney said Schrenker sent the family a letter accusing them of defaming him and issuing veiled threats to sue them.

Kimble Richardson, a licensed mental health counselor at St. Vincent Stress Center, said such defensive tactics are common among people who operate in such a manner.

"When somebody gets too close to the truth, it's like a cat that's backed into a corner," Richardson said. "They come out fighting."

Moving ahead

The national exposure of the Schrenker case should serve as a warning about Americans' high regard for success and wealth, said Jim Rubens, author of the book "OverSuccess: Healing the American Obsession with Wealth, Fame, Power and Perfection." Although awareness is greater, he said, it remains to be seen how much momentum such cases provide for changing Americans' behavior.

For Smith and others, the experience has been a wake-up call.

"I think the whole country has seen you can be taken in a minute," he said.

April 12, 2009

As Marcus Schrenker's plane crashed, so did his high-rolling imageExperts say those who project wealth, success are too easily trusted.

By Francesca Jarosz

Dave Smith first met Fishers financial adviser Marcus Schrenker in June 2004, when Schrenker flew his plane to Atlanta to discuss Smith's finances.

Smith, a retired Delta Air Lines pilot who lives in Roswell, Ga., was blown away by Schrenker's immaculate appearance, expensive turboprop plane and apparent knowledge of Delta's financial problems.

He decided on the spot to invest with Schrenker, entrusting him to handle about $1.3 million in retirement savings.

"It was like so many times in your life when you think, 'God brought him to help,' " Smith said.

Five years later, Schrenker, 38, is being held at the Escambia County Jail in Pensacola, Fla., faced with federal charges that he tried to fake his own death in a plane crash after being accused of bilking hundreds of thousands of dollars from investors, including Smith.

He is scheduled to appear in federal court April 24 for a hearing to determine his competency to stand trial.

Schrenker's life and the events that led to his arrest are filled with made-for-TV movie details. But experts say how he, and those he allegedly duped, got to this point illustrates a broader cautionary tale about trust and about how so many people are drawn to those in society who project wealth, knowledge and success.

The downfall of Schrenker and others, such as Ponzi scheme artist Bernard Madoff, has provided a fresh look at the corruption that sometimes underlies financial achievement. That awareness, experts say, could create a greater skepticism of wealth and provide a wake-up call about using it as a basis of trust.

"There's a general suspicion of American business at this point -- you'd see the same thing in the 1930s," said Jerald Podair, a professor at Lawrence University in Appleton, Wis., who teaches a course on the Great Depression and the New Deal. "It's the Schrenkers of the world that give people that suspicion. He built this lifestyle that was supposed to project the American Dream, but it was a warped version of it that was built on deceiving people."

On Jan. 11, Schrenker flew his plane from Anderson, bound toward Florida. Hours later, authorities say, he placed a distress call and put his aircraft on autopilot before parachuting into central Alabama. The plane crashed in the Florida Panhandle, and authorities found Schrenker Jan. 13 at a Florida campground, bleeding from a slit wrist.

He is accused of intentionally crashing his plane and putting out a false distress call. His trial is set for June 8 in U.S. District Court in Pensacola.

After that, Schrenker will return to Indiana to face charges that he worked as an investment adviser without being registered. If convicted in both criminal cases, he could face a maximum of 42 years in prison and up to $520,000 in fines, plus restitution.

In a letter sent in March to Indiana officials, his family and media outlets, Schrenker said he'd been mentally unstable and abusing prescription drugs at the time investigators allege he bilked clients out of hundreds of thousands of dollars.

Schrenker said the plane episode was an accident and denied trying to evade authorities or leave the country.

"There is a lot the public doesn't know and soon the truth of what really happened on 1-11-2009 will be told," Schrenker wrote.

He left behind his wife, Michelle, who had recently filed for divorce; Kelly Baker, with whom he'd been having an affair for about a year; myriad lawsuits and civil cases against him and his companies, Icon Wealth Management, Heritage Wealth Management and Heritage Insurance Services.

The plane crash appeared to many as an attempt to flee a life that Schrenker once worked meticulously to create.

Gaining trust

Those who know Schrenker say he worked tirelessly to project an image of success.

He sported suspenders and ties almost every business day and kept his hair cut military-style, said Erick Krauter, a former landlord. He was known for sporting Armani suits, cuff links and monogrammed shirts.

The same care went into the upkeep of his three-story Geist home, where he washed the garage floor every night with steaming hot water, said Tamra Boles, who was friends with Marcus and Michelle in 2005. His office, too, was decked out with security cameras, state-of-the-art electronics, expensive light fixtures and granite tiling in the bathrooms.

"Everything about this man had to be perfect -- his office, his house," Krauter said. "He was absolutely over the top in everything he did."

Schrenker flaunted his wealth to friends, business partners and neighbors -- often talking about his companies' success or how much his cars cost. At his 10-year high school reunion, he handed out business cards with a picture of him and Michelle standing in front of their Lexus and plane.

For Michelle's 32nd birthday party, he hired a local band, flashed names of guests from a projector and ended the night with a fireworks show.

"A lot of people wanted to be him," said Dane Lantz, who took care of Schrenker's plane at Mount Comfort Airport, where many employees frequented the financial adviser's social events. "He had the planes and the cars and the (expensive) house."

Michael Edesess is chief investment officer for Fair Advisors, a Denver-based firm that attempts to ensure advisory work is done ethically. He said potential investors are easily misled by the appearance of wealth.

\

"They think, 'That person looks like they know how to make money, therefore they'll know how to make money for me,' " Edesess said. "The logical progression that they don't seem to make is, that person is wealthy, so he knows how to make money from me."

Former clients said Schrenker used his wealth to win them over, buying them artwork and GPS units and taking them out to expensive restaurants. He'd also become close to their families, calling to inquire about their children and to wish them a happy birthday.

Smith said that during his initial meeting with Schrenker, he was impressed by his businesslike talk, laced with statements such as, "We have people inside of Delta, and we know what's going on and it's bad."

But it was Schrenker's cordial, professional demeanor and his well-groomed, athletic appearance that sold him.

"I remember thinking, 'If he takes care of himself that well, he probably takes care of everything that well.' "

Coming out fighting

Schrenker's charm quickly won over clients and friends, but beneath the surface, many said he was a manipulative bully waiting to be unleashed.

Steve Shea, a retail developer who lives in Schrenker's neighborhood, became friends with him in 2002 through mutual acquaintances. They began a business relationship in 2004, when Schrenker became a tenant in one of Shea's retail developments.

Problems soon followed.

Schrenker refused to execute his six-month lease on the property and began finding flaws in the building -- excuses, Shea said, to avoid paying his rent. He sent Shea pages of e-mails with pictures of light switch plates that had screws missing, areas of the carpet where threads were loose and toilet paper rolls, which he said were not replaced each night.

In the e-mails, he warned about the dangers of electrical shorts, falls on the carpet and unsanitary conditions. On one occasion, he brought in Occupational Safety and Health Administration officials to test the building's air quality because someone was smoking in the building.

"It was always positioning to avoid paying the rent," said Shea, who kicked Schrenker out of the building about four months after he moved in. "The way to defend his position was to try to intimidate the other person."

The Kinney family said Schrenker used intimidation tactics on them, too.

Schrenker became close to members of the family, calling them in the middle of the week to check in, and on occasion spending weekends at their lake house.

But when Mike Kinney, a dentist from Roswell, Ga., began questioning Schrenker's handling of his funds after he noticed some money missing, he said Schrenker berated him for bothering him with calls.

Schrenker eventually resigned as Kinney's adviser, saying that he was potentially litigious as a client and that he harassed his staff.

After Kinney's parents, Harold and Margie, locked Schrenker out of their accounts because they also noticed money was missing, Kinney said Schrenker sent the family a letter accusing them of defaming him and issuing veiled threats to sue them.

Kimble Richardson, a licensed mental health counselor at St. Vincent Stress Center, said such defensive tactics are common among people who operate in such a manner.

"When somebody gets too close to the truth, it's like a cat that's backed into a corner," Richardson said. "They come out fighting."

Moving ahead

The national exposure of the Schrenker case should serve as a warning about Americans' high regard for success and wealth, said Jim Rubens, author of the book "OverSuccess: Healing the American Obsession with Wealth, Fame, Power and Perfection." Although awareness is greater, he said, it remains to be seen how much momentum such cases provide for changing Americans' behavior.

For Smith and others, the experience has been a wake-up call.

"I think the whole country has seen you can be taken in a minute," he said.

Monday, March 23, 2009

New Problems for Schrenker

March 23, 2009

Parachuting Financier Hit With Fines, Restitution

By THE ASSOCIATED PRESS

Filed at 12:08 p.m. ET

INDIANAPOLIS (AP) -- A money manager accused of trying to fake his death in a plane crash has taken another financial hit.

Under an Indiana judge's order made public Monday, Marcus Schrenker must pay $304,000 in restitution to bilked investors and $280,000 in state fines. Investors told the judge in January that Schrenker cost them hundreds of thousands of dollars in losses.

Schrenker already was facing millions in judgments and potential penalties, ranging from an insurance company's lawsuit seeking $1.4 million in commissions to a judge's order that he pay $12 million in a lawsuit over the sale of a plane.

Schrenker was arrested in January after authorities say he bailed out of his plane to flee financial ruin. He faces federal charges stemming from his plane's crash in Florida.

Copyright 2009 The Associated Press

Parachuting Financier Hit With Fines, Restitution

By THE ASSOCIATED PRESS

Filed at 12:08 p.m. ET

INDIANAPOLIS (AP) -- A money manager accused of trying to fake his death in a plane crash has taken another financial hit.

Under an Indiana judge's order made public Monday, Marcus Schrenker must pay $304,000 in restitution to bilked investors and $280,000 in state fines. Investors told the judge in January that Schrenker cost them hundreds of thousands of dollars in losses.

Schrenker already was facing millions in judgments and potential penalties, ranging from an insurance company's lawsuit seeking $1.4 million in commissions to a judge's order that he pay $12 million in a lawsuit over the sale of a plane.

Schrenker was arrested in January after authorities say he bailed out of his plane to flee financial ruin. He faces federal charges stemming from his plane's crash in Florida.

Copyright 2009 The Associated Press

Friday, March 20, 2009

Judge to determine if Schrenker is competent to stand trial

Posted:

March 19, 2009 05:36 PM EST

Chris Proffitt/Eyewitness News

Miami - Psychiatric experts have handed a Hamilton County judge their mental evaluation of Geist businessman Marcus Schrenker.

Schrenker is still in jail in Florida, accused of trying to fake his death and intentionally crashing his plane.

Saying that he was heavily medicated and under extreme stress a full year before his capture in a Florida campground after an apparent suicide attempt, Marcus Schrenker told Indiana authorities in a recent letter that he didn't try to fake his death in a plane crash.

Since last month, the former Geist money manager has undergone a mental evaluation in a Florida federal detention center to determine if he's competent to stand trial on charges that he intentionally crashed his airplane into the Florida panhandle after radioing a fake distress call. But before then, Marcus Schrenker faced divorce, lawsuits and an investigation into allegations that he bilked investors out of hundreds of thousands of dollars and perhaps more.

"This is a classic example of affinity fraud. The kind of fraud that happens by those we come to know, love and trust," said Todd Rokita, Indiana secretary of state.

With their assets frozen by an Indiana judge, Michelle Schrenker, publicly distancing herself from her husband's troubles, appeared on NBC's Today Show.

"He took the deposits and that was never something I did. My focus was always my family. It was never the company," said Michelle Schrenker.

Marcus Schrenker faces felony charges in Hamilton County related to his business dealings in Indiana. But what if he's found incompetent to stand trial on federal charges in Florida? Could that affect his prosecution here? Prosecutors say either way, Schrenker is expected to return to Indiana in late June or early July.

"Under Indiana law, if he's found not to be competent to stand trial, he would be consigned to the Department of Mental Health for evaluation and treatment. There he would remain until competent to stand trial," said Jeffrey Wehmueller, Hamilton County chief deputy prosecutor.

A judgment over whether Marcus Schrenker is competent to stand trial in Florida has already been made and now rest in the hands of a federal judge.

Schrenker was moved to a federal detention center in Tallahassee this week. The judge in the case is expected to set a hearing soon before ruling whether Schrenker is competent to stand trial.Marcus Schrenker is the subject of an hour-long report Friday night on Dateline NBC. It begins at 10:00 pm on Channel 13.

Pilot mystery - Read stories and watch video related to this case.

All content © Copyright 2002 - 2009 WorldNow and WTHR. All Rights Reserved.

March 19, 2009 05:36 PM EST

Chris Proffitt/Eyewitness News

Miami - Psychiatric experts have handed a Hamilton County judge their mental evaluation of Geist businessman Marcus Schrenker.

Schrenker is still in jail in Florida, accused of trying to fake his death and intentionally crashing his plane.

Saying that he was heavily medicated and under extreme stress a full year before his capture in a Florida campground after an apparent suicide attempt, Marcus Schrenker told Indiana authorities in a recent letter that he didn't try to fake his death in a plane crash.

Since last month, the former Geist money manager has undergone a mental evaluation in a Florida federal detention center to determine if he's competent to stand trial on charges that he intentionally crashed his airplane into the Florida panhandle after radioing a fake distress call. But before then, Marcus Schrenker faced divorce, lawsuits and an investigation into allegations that he bilked investors out of hundreds of thousands of dollars and perhaps more.

"This is a classic example of affinity fraud. The kind of fraud that happens by those we come to know, love and trust," said Todd Rokita, Indiana secretary of state.

With their assets frozen by an Indiana judge, Michelle Schrenker, publicly distancing herself from her husband's troubles, appeared on NBC's Today Show.

"He took the deposits and that was never something I did. My focus was always my family. It was never the company," said Michelle Schrenker.

Marcus Schrenker faces felony charges in Hamilton County related to his business dealings in Indiana. But what if he's found incompetent to stand trial on federal charges in Florida? Could that affect his prosecution here? Prosecutors say either way, Schrenker is expected to return to Indiana in late June or early July.

"Under Indiana law, if he's found not to be competent to stand trial, he would be consigned to the Department of Mental Health for evaluation and treatment. There he would remain until competent to stand trial," said Jeffrey Wehmueller, Hamilton County chief deputy prosecutor.

A judgment over whether Marcus Schrenker is competent to stand trial in Florida has already been made and now rest in the hands of a federal judge.

Schrenker was moved to a federal detention center in Tallahassee this week. The judge in the case is expected to set a hearing soon before ruling whether Schrenker is competent to stand trial.Marcus Schrenker is the subject of an hour-long report Friday night on Dateline NBC. It begins at 10:00 pm on Channel 13.

Pilot mystery - Read stories and watch video related to this case.

All content © Copyright 2002 - 2009 WorldNow and WTHR. All Rights Reserved.

Sunday, March 8, 2009

Unredacted Schrenker Letter

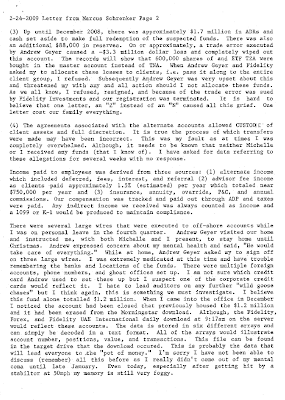

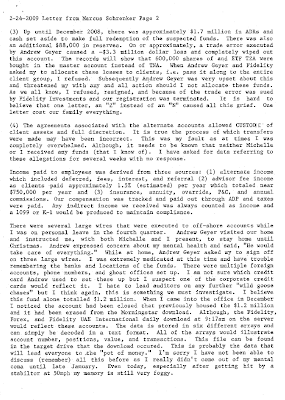

PDF SCANS OF LETTER AT BOTTOM OF THE NEWS ARTICLE.

Hosted by Back to Google News

Money manager denies intentionally crashing plane

By CHARLES WILSON – 2 days ago

INDIANAPOLIS (AP) — A money manager charged with trying to escape financial ruin by faking his death in a plane crash denies staging the accident and says in a letter to authorities his estranged wife had no part in any misdealings.

Marcus Schrenker, who's accused of bilking investors of hundreds of thousands of dollars, sent a seven-page letter to Indiana authorities asking them to unfreeze the assets of his wife, Michelle, who is listed as his company's chief financial officer. He also offers to make restitution in return for reduced charges.

"There isn't a moment that goes by that I don't deeply regret the mistakes our company made and hope all parties will let me take responsibility for the financial issues surrounding the alleged funds that clients are missing," Schrenker wrote in the Feb. 24 letter, a copy of which was obtained Friday by The Associated Press.

Jim Gavin, a spokesman for the Indiana secretary of state's office, which regulates securities, confirmed the agency had received the letter this week but declined to comment on its contents.

Gavin said Secretary of State Todd Rokita would continue to press the case in court and will "not let any party benefit from wrongly gotten wealth."

A message seeking comment was left at the Indiana attorney general's office, to which the letter also was addressed.

Schrenker, 38, was arrested at a Tallahassee, Fla., campground on Jan. 13, two days after authorities say he put his plane on autopilot and jumped out over Alabama to flee personal and financial problems. The plane crashed about 200 miles away in Florida, where he is being held on federal charges stemming from the crash.

He also faces felony charges tied to his financial dealings in Indiana, is named in more than a half-dozen lawsuits and has lost millions of dollars in legal judgments. His wife filed for divorce Dec. 30, the day before investigators searched his home.

State attorneys have placed the assets of both Schrenkers in a court-controlled receivership — including the couple's suburban Indianapolis home assessed at $1.4 million, where Michelle Schrenker and the couple's three children live.

The state contends Michelle Schrenker withdrew tens of thousands of dollars from bank accounts that also included investor money in the week before she filed for divorce.

She denies any wrongdoing and says all she did was handle the payroll and pay bills. Her lawyer is appealing the receivership decision.

The letter seemed intended to reinforce her arguments.

"Michelle has never received any compensation, assets, indirectly or directly, from client funds," it said. "Assessing her assets, and taking receivership, is wrong.

"There is no honor in throwing kids out on the street, especially at times like these."

The Associated Press left a message seeking comment with attorney Mary Schmid, who is representing Michelle Schrenker.

Marcus Schrenker also flatly denies trying to fake his own death or evade authorities and says he suffered a head injury in the plane crash that resulted in a loss of memory. He said he had intended to visit his father in Florida and take a motorcycle trip.

"The accident was just that, an accident," he wrote.

Schrenker also repeated claims made in an earlier interview with The New York Post that he was under psychiatric care and on medication for more than a year. He said he had been mentally incompetent due to stress and a prescription drug problem.

"I was simply overwhelmed, could no longer reason, and made some poor investment choices," he wrote.

Copyright © 2009 The Associated Press. All rights reserved.

Related articles

Financial adviser Schrenker declares he's innocentIndianapolis Star - Mar 6, 2009

Ind. money manager denies trying to fake deathThe Associated Press - Mar 6, 2009

Indiana man denies faking his own deathShelby County Reporter - Mar 6, 2009

More coverage (7) »

Click on the images to enlarge.

Free Counter

Hosted by Back to Google News

Money manager denies intentionally crashing plane

By CHARLES WILSON – 2 days ago

INDIANAPOLIS (AP) — A money manager charged with trying to escape financial ruin by faking his death in a plane crash denies staging the accident and says in a letter to authorities his estranged wife had no part in any misdealings.

Marcus Schrenker, who's accused of bilking investors of hundreds of thousands of dollars, sent a seven-page letter to Indiana authorities asking them to unfreeze the assets of his wife, Michelle, who is listed as his company's chief financial officer. He also offers to make restitution in return for reduced charges.

"There isn't a moment that goes by that I don't deeply regret the mistakes our company made and hope all parties will let me take responsibility for the financial issues surrounding the alleged funds that clients are missing," Schrenker wrote in the Feb. 24 letter, a copy of which was obtained Friday by The Associated Press.

Jim Gavin, a spokesman for the Indiana secretary of state's office, which regulates securities, confirmed the agency had received the letter this week but declined to comment on its contents.

Gavin said Secretary of State Todd Rokita would continue to press the case in court and will "not let any party benefit from wrongly gotten wealth."

A message seeking comment was left at the Indiana attorney general's office, to which the letter also was addressed.

Schrenker, 38, was arrested at a Tallahassee, Fla., campground on Jan. 13, two days after authorities say he put his plane on autopilot and jumped out over Alabama to flee personal and financial problems. The plane crashed about 200 miles away in Florida, where he is being held on federal charges stemming from the crash.

He also faces felony charges tied to his financial dealings in Indiana, is named in more than a half-dozen lawsuits and has lost millions of dollars in legal judgments. His wife filed for divorce Dec. 30, the day before investigators searched his home.

State attorneys have placed the assets of both Schrenkers in a court-controlled receivership — including the couple's suburban Indianapolis home assessed at $1.4 million, where Michelle Schrenker and the couple's three children live.

The state contends Michelle Schrenker withdrew tens of thousands of dollars from bank accounts that also included investor money in the week before she filed for divorce.

She denies any wrongdoing and says all she did was handle the payroll and pay bills. Her lawyer is appealing the receivership decision.

The letter seemed intended to reinforce her arguments.

"Michelle has never received any compensation, assets, indirectly or directly, from client funds," it said. "Assessing her assets, and taking receivership, is wrong.

"There is no honor in throwing kids out on the street, especially at times like these."

The Associated Press left a message seeking comment with attorney Mary Schmid, who is representing Michelle Schrenker.

Marcus Schrenker also flatly denies trying to fake his own death or evade authorities and says he suffered a head injury in the plane crash that resulted in a loss of memory. He said he had intended to visit his father in Florida and take a motorcycle trip.

"The accident was just that, an accident," he wrote.

Schrenker also repeated claims made in an earlier interview with The New York Post that he was under psychiatric care and on medication for more than a year. He said he had been mentally incompetent due to stress and a prescription drug problem.

"I was simply overwhelmed, could no longer reason, and made some poor investment choices," he wrote.

Copyright © 2009 The Associated Press. All rights reserved.

Related articles

Financial adviser Schrenker declares he's innocentIndianapolis Star - Mar 6, 2009

Ind. money manager denies trying to fake deathThe Associated Press - Mar 6, 2009

Indiana man denies faking his own deathShelby County Reporter - Mar 6, 2009

More coverage (7) »

Click on the images to enlarge.

Free Counter

Subscribe to:

Posts (Atom)